The spring market is underway in the Fox Valley! It’s time to do a little spring cleaning and shake off the cold hand of winter to find your new home. We’ve got a lot of new programs to help folks find the perfect loan program, including ultra low down payments, special terms for Kane County renters, great Illinois home incentive programs and more. Check out this list and be sure to call for more details!

Kane County Buyer’s Program:

KANE COUNTY – Fox Valley First Time Home Buyer Programs

If you’re looking to buy right where you live, in Kane county, you’re in luck! They offer a wonderful down payment assistance program for first time home buyers. With a down payment of 1% of the purchase price, you can become a home owner instead of paying your landlord! Ask about the other county specific programs available too.

But that’s not all! There are many more programs available for home buyers to look into:

@HomeIllinois

@Home Illinois – an IHDA program

This program offering up to $5,000 in down payment and closing cost assistance for FHA, VA, USDA and Conventional loans. Qualifying borrows include first time buyers, veterans, repeat buyers and those who want to refinance. Borrowers must meet income and purchase limits, credit requirements and contribute $1,000 or 1 % of the purchase price, whichever is greater.

1stHome Illinois

1st Home Illinois – an IHDA program

This is a program similar to IHDA’s (see above) but is only available to first time buyers and veterans purchasing a home in Boone, Cook, DeKalb, Fulton, Kane, Marion, McHenry, St. Clair, Will and Winnebago counties. Qualifying buyers get $7,500 cash assistance for down payment and closing costs for a low-cost 30 yr fixed rate mortgage. They must contribute $1,000 or 1% of the purchase price whichever is greater.

FHA Loans

HUD for FHA Loans

This is a very popular type of loan for first time home buyers. This is a federally backed mortgage by the Federal Housing Administration (FHA) and offers a 3.5% down payment, low closing costs and the less-than-perfect-credit score is accepted. Limits on the purchase price in the Chicago land area are up to $365,700 Check the link below for details.

FHA Home Loans by First Click Mortgage

HomeReady Mortgage by Fannie Mae

HomeReady Mortgage by Fannie Mae

HomeReady offers a 3% down payment option for eligible low-to-moderate income first time and repeat buyers. Additional income sources will be considered an all co-borrowers don’t have to live in the property. Home buyers must complete a home ownership education course.

Home Possible Advantage by Freddie Mac

Home Possible Advantage by Freddie Mac

Home Possible Advantage is Freddie Mac’s version of the 3% down payment mortgage loan. The program is also open to qualifying low-to-moderate income first time or repeat buyers or those purchasing in high-cost or under served areas. First time buyers must complete home ownership counseling.

USDA Single Family Housing Guaranteed Loan Program

USDA Single Family Housing

Buy a home in certain rural areas and you might not need any down payment at all. This U.S. Department of Agriculture (USDA) program assists low and moderate income consumers buy homes in eligible rural areas, including many counties in Illinois. A low interest, fixed rate loan can be used to build, rehab, improve or relocate a dwelling in an eligible area.

VA Home Loan Program

VA Home Loan Program

VA loans are another great tool for veterans and their families looking to buy a home without a down payment. The loans are only for qualifying veterans, active milityar members and eligible surviving spouses. Guaranteed by the U.S. Dept of Veterans Affairs, the loans to do not require mortgage insurance.

Questions on the loan programs?

Contact a Senior Loan Originator with People’s Home Equity

Steve Smither

Senior Mortgage Adviser

NMLS #224681

1801 S Meyers Rd. #500

Oakbrook Terrace, IL. 60181

Cell: 847-942-5151

Fax: 847-701-3267

ssmither@peopleshomeequity.com

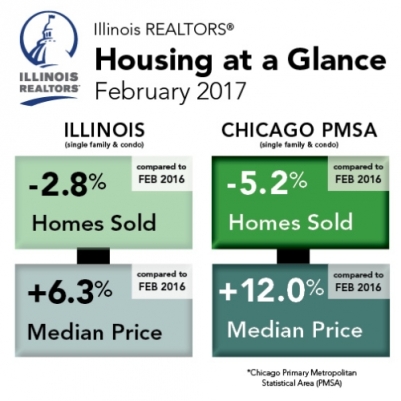

Did you know?

Fox Valley Homes is full of great home tips, ideas and programs for all levels of buyer and sellers. In addition to helping owners with distressed homes and foreclosures, Fox Valley Homes offers full broker service for regular listings, rentals, buyers and home sellers, as well as investors in residential properties across the northern Illinois and Chicago region. We coordinate real estate transactions effectively and retain the full skills and expertise of fully licensed Realtors®, including access to the resources of the local Illinois MLS database.

For more information about programs to list or buy with Fox Valley Homes, please contact Jennifer Kinzle, e-PRO, SFR, (630) 854-4360. Email me direct jkinzle73@gmail.com.

Contact me:

Jennifer Kinzle, e-PRO, SFR Broker

Direct/Text: (630) 854-4360

Email: jkinzle73@gmail.com

Twitter: @jkinzle

Instagram: @jkinzle

Facebook: Fox Valley Homes – Jennifer Kinzle, Broker

Fox Valley Investors Group: Fox Valley Investor Group – on Facebook

Website: www.FoxValleyShortSales.com

MeetUp: Fox Valley Investors MeetUp Group